Contango meaning in Hindi Meaning of Contango in Hindi Translation

Contents

The only way out of super contango is for the supply of a commodity to fall sharply or for more storage space to be created or for the inventories to be rapidly used up. Take a Future on the Nifty which is trading at a spot of 17,350 and the futures price is 17,520. Therefore, the futures premium, in this case, is 170 points for a one-month contract or 0.98%.

However, when you hold the futures contract for 1 month there is an interest cost for the margin of around 40% that has been paid. Let us assume that the cost of carrying, in this case, is Rs.100, which is the interest cost of holding the futures contract. That means the theoretical price of the futures should be spot price plus the cost of carrying.

Contango: Free WordPress Theme – DesignOrbital

Most recently, we saw this happening in oil contracts in April 2020 when the spot price of oil dipped to negative as the world ran out of storage space due to a glut of oil. It is called a Black Swan even as it happens very rarely. In the aftermath of the preventive measures against the spread of Coronavirus, there were severe economic repercussions.

- Shipping cost, delivery date and order total shown at checkout.

- In India, trading of oil is done in Multi Commodity Exchange or MCX.

- Weak demand and too much supply led to a sudden spurt in demand for storage of oil, which set in motion the super contango as the storage spaces quickly started getting used up.

- To avoid this, just log on to our website and understand the meaning of financial terms with the Financial Dictionary.

- Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant.

Internationally, there are two benchmarks for oil futures. These are North Sea Brent Crude and West Texas Intermediate . North Sea Brent is traded on the Intercontinental Exchange by countries in Europe, Africa and the Middle East, while WTI is traded in North America on the New https://1investing.in/ York Mercantile Exchange or NYMEX. In India, trading of oil is done in Multi Commodity Exchange or MCX. If the contract costs of future contracts with longer terms to maturity area unit on top of those with shorter terms to maturity, it’s known as a normal futures curve.

This indicator can be useful to show contango or backwardation between spot and derivative prices via exchange, giving potential indication for funding and reversal. Secondly, there is the insurance cost, which is a very important part of commodity futures because commodities can get damaged by theft, pilferage, forces The End Of EAFE of nature, acts of war, fire, etc. In such cases, if contracts are uninsured then it can lead to huge losses for the owner of the commodity. When oil prices decline, gasoline prices decrease, and this is beneficial to the consumers. However, prices are falling today because people are travelling a lot less.

Companies to Explore

Griggs is among crypto newcomers deploying systematic strategies that are tried-and-tested in conventional asset classes — price arbitrage, futures trading, options writing — in a booming new corner of finance. Brent crude futures fell 68 cents to $71.39 a barrel by 1453 GMT, having backed off a session high of $73.08. Kindly make sure you read the account opening documents as prescribed by SEBI.

The Army Welfare Education Society, known as AWES, had released AWES Army Public School Recruitment Notification 2022. Through this recruitment process, teachers will be recruited for 136 Army Public Schools situated in various military and cantonment areas across India. The candidates can apply for the post online from 25th August 2022 to 5th October 2022. The willing candidates should go through the AWES Army Public School Preparation Tips to have an edge over others in the exam. US crude was up by $1.04, or 5.2 per cent, at $21.13 a barrel, after settling in the previous session at $20.09, its lowest since February 2002.

Contango Holdings News & Analysis

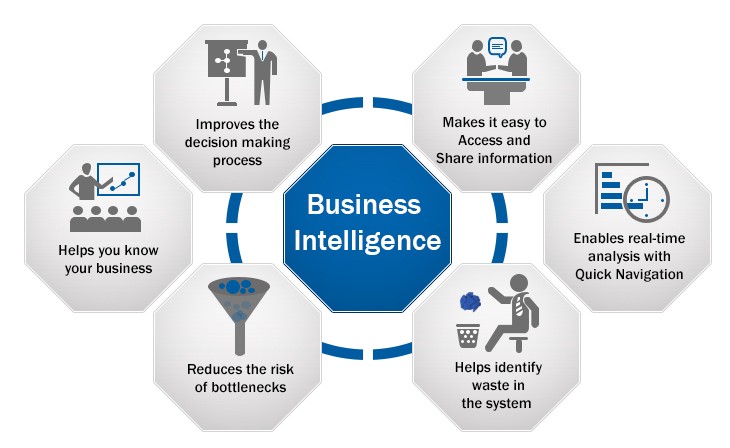

However, there is a cost that contango imposes, especially if you are long on the contract. For example, contango occurs when the futures curve slopes upwards. That means; the futures price is more than the spot price.

What is the address of CONTANGO TRADING & COMMODITY PRIVATE LIMITED?

CONTANGO TRADING & COMMODITY PRIVATE LIMITED is having registered office at ABAN HOUSE; 2ND FLOOR; SAIBABA MARG; OFF. K. DUBHASH MARG; FORT; MUMBAI; Maharashtra; 400023; India.

Glassdoor gives you an inside look at what it’s like to work at Contango IT, including salaries, reviews, office photos, and more. All content is posted anonymously by employees working at Contango IT. All answers shown come directly from Contango IT Reviews and are not edited or altered. On Fishbowl, you can share insights and advice anonymously with Contango IT employees and get real answers from people on the inside. After resignation and joining to the new company in between i found one bad thing that is in some cases where we do not get the salary of the last month saying it will come along with FNF.

What Is contango and backwardation?

Saudi Arabia is expected to increase the July OSP for Arab Light crude by $3.80 a barrel on average. In the 1990s boom years, commodity bid-ask spreads were so wide you could drive a freight truck through them. Global crude markets will be center stage this week in the final countdown to Opec’s next meeting. Here’s a look at the how the key commodities are likely to perform in today’s trade.

What is the state of the Contango trading & commodity private limited incorporation?

The state in which company is incorporated is Mumbai.

When the spot price of a commodity is lower than the futures price it tends to generate an upward sloping forward curve. This market is in contango i.e., the futures prices are quoting at a premium to the spot price. For example, in physically delivered commodities, contango comes about due to factors like storage, demurrage, financing, and insurance costs. In the case of cash-settled futures like index futures and currency futures, the contango is just driven by the time value of money or the implied interest rate in the market. In a nutshell, futures price premium to spot is contango, a deep premium is a super contango, and the futures price at a discount to spot price is backwardation.

Contango is more to do with expectations of future prices. Hence this expectation of future price is considered to be positive only when the future is more than the spot price plus the cost of carrying. We will come back to the cost of carrying later but for now, let us focus on the difference between contango and futures premium. It is hard to say that Contango is bad, because it is a normal occurrence in the futures market.

It’s not as cheap as WTI, which is the benchmark U.S. oil. Some states in India have seen petrol/ diesel sales as a natural source of adding revenue to meet the additional social and medical cost of COVID 19 by putting surcharge to the sale price. If a physical plus is to be delivered sometime in future as against the current time, the vendor incurs a storage price and thence costs are higher for future delivery. This indicator calculates difference between price of Bitmex’s XBTUSD, and Bitmex’s two nearest futures. If the difference is negative, then it is backwardation.

Contango Overview

On 20th April, prices as per West Texas Intermediate (WTI- the benchmark for oil from U.S. oilfields), fell to a negative $37.63 a barrel, the first time in history. The global international index Brent , on which 2/3 of world’s oil trade is based, was at around $20. This indicator shows the popular crypto exchanges for Bitcoin spot and futures . This allows you to not have all of the “compare” indicators on the chart, as this combines it all in one.

What is the status of CONTANGO TRADING & COMMODITY PRIVATE LIMITED?

CONTANGO TRADING & COMMODITY PRIVATE LIMITED is having Strike Off status.

The focus is here on understanding contango and super contango. We shall also look at how this contango and super contango impact the spot prices and what are the circumstances under which contango and super contango come about. We shall also look at terms like the contango market and contango meaning in practical terms. Traders generally tend to get confused between futures premium and contango. These are related but they are two different things altogether.

Bullishindicator, showing that the market expects the price of the futures contract to increase steadily into the future. Contango is a situation where thefutures price of a commodity is higher than the spot price. There are times, however, when the shorter-dated contracts cost more than the longer-dated ones. No need to issue cheques by investors while subscribing to IPO.

Our payment security system encrypts your information during transmission. We don’t share your credit card details with third-party sellers, and we don’t sell your information to others. Proper understanding of Contango and Backwardation concept helps a hedger foresee liquidity issues due to margin requirements in a future contract. If you’re well versed with the fundamentals of future market, you may well have detected of the words Contango and backwardation. Ostensibly troublesome owing to the jargon, this is often truly an easy thought and can potentially be tested as theory queries in FRM and CFA.